Economic Policy

Improving the Earned Income Tax Credit for Black Workers Without Children

The Earned Income Tax Credit (EITC)-one of the few poverty reduction programs offered through the federal tax code-is also one of the most important poverty reduction programs in the United States. As a refundable tax credit, the EITC reduces a household’s federal income tax bill by the credit’s value. The IRS returns any excess amount to the household as a lump sum after the household files taxes. Only people working during a given tax year with low or moderate pay are eligible to file for the credit, and thus the credit reduces poverty by both supplementing income and increasing the incentive to work.1 In 2018, the EITC lifted approximately 5.6 million people above the poverty line, including about 3 million children, and reduced poverty severity for 16.5 million people.2

Black workers with children benefit from the EITC because the credit most effectively targets parents who are low- to moderate-income workers. Black workers and many other workers of color are concentrated in lower-wage jobs because of occupational segregation, a tendency to work part-time, and the wage disparities within occupations.3 According to the U.S. Census Bureau, the typical Black household earned $46,600 in 2020.4 This falls just below the maximum income to qualify for the EITC for a married couple filing jointly and claiming one dependent.

As a result, the credit applies to large swaths of Black workers. An estimated 3.2 million Black women (21 percent of all Black women) benefit from the EITC compared to 13 percent of women overall. Black women also tend to receive a larger credit, on average, than women overall.5

However, the EITC’s design prevents millions of childless workers from receiving meaningful benefits that could increase after-tax incomes and decrease poverty. The credit’s value varies based on income, marital status, and the number of children claimed. The credit provides substantial benefits for workers with at least one child, but minimal benefits for workers who do not claim children as dependents when they file taxes. Moreover, the EITC for childless workers has historically been limited to those aged 25 to 64, which has excluded millions of younger and older working adults without children. Expanding the EITC’s poverty reduction and income boosting benefits for Black childless workers is a simple but critical policy change.

In early 2021, the American Rescue Plan temporarily expanded the EITC for working adults without children. The reforms boost the size of the credit, raise the income limit for these adults to qualify, and cover younger workers aged 19-24 and older workers aged 65 and over for tax year 2021. As a result, for tax year 2021, this larger EITC will provide income support for 2.7 million Black childless workers.6 The Build Back Better Act currently being debated in Congress would extend this important expansion through 2022. Congress should pass this legislation and look to enact further legislation to permanently improve the credit for childless workers.

The EITC Provides Limited Help to Childless Black Workers

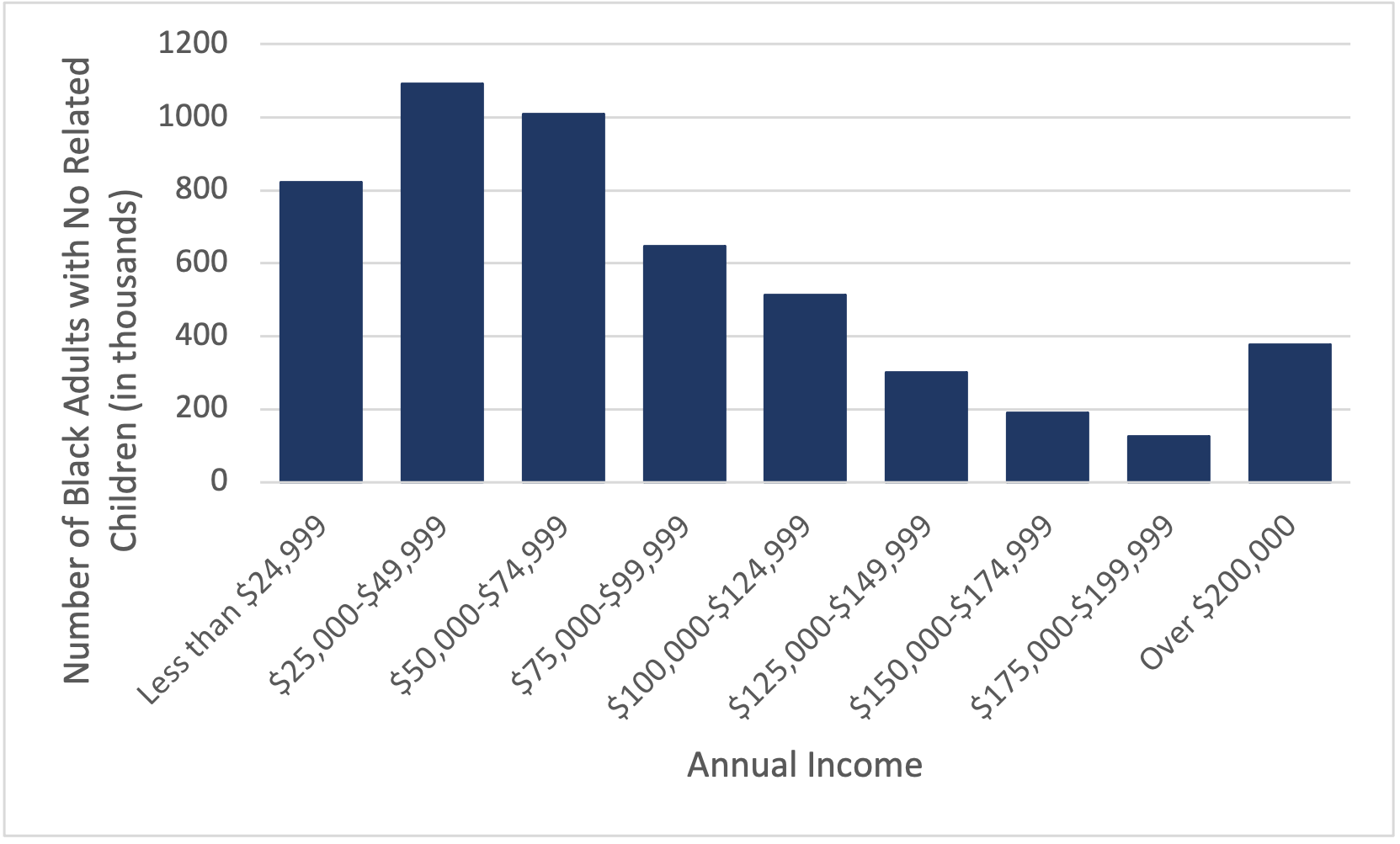

The permanent (pre-American Rescue Plan) design of the EITC for childless workers provides minimal benefits to a limited number of workers. These limits harm childless Black workers, who tend to earn low to moderate incomes. The credit amount, income limit, age requirements, and structure of the EITC for childless workers limit childless Black workers from accessing critical income supports.

Figure 1: Childless Black People Tend to Earn Low to Moderate Incomes

Source: Joint Center analysis of Current Population Survey, 2021 Annual Social and Economic Supplement.

The U.S. tax code taxes many childless workers into poverty. The permanent EITC for childless workers is not large enough to offset federal income and payroll taxes for some workers, resulting in an after-tax income below the poverty level (see box). According to the Center on Budget and Policy Priorities, the federal tax code taxes more than 1 million childless Black adults aged 19-65 into poverty or deeper into poverty.7

Childless workers are often left behind in poverty reduction programs. When federal policymakers extended the credit to childless workers in 1993, decreasing poverty for this population was not the primary intention.8 Only low-income childless workers face federal income and payroll taxes that could lower their after-tax income below (or further below) the poverty line.9 The standard deduction, child tax credit, and EITC for families with children are large enough to ensure that families with children are not taxed into (or deeper into) poverty, but childless low-income adults do not enjoy those same protections.10

How does the tax code tax childless workers into poverty?

For many childless workers, the EITC is too small to offset federal income and payroll taxes. For example, a 25-year-old single cashier earning the federal minimum wage ($7.25 per hour) and working 35 hours per week earns $13,195 per year. In 2019, she would qualify to receive an EITC of just $183. The standard deduction ($12,200) leaves her with a taxable income of $1,005. She is in the 10 percent tax bracket, so she has a $101 income tax liability. Her payroll taxes include the employee share of Social Security withholding at 6.2 percent ($747.97) and Medicare withholding at 1.2 percent ($144.77). Her EITC leaves her with a credit of $183 against $994 owed. Her after-tax income for 2019 would be $12,384, which is below the $12,490 (2019) federal poverty guideline for a single person.

The maximum incomes for childless EITC claimants are too low. The pre-American Rescue Plan maximum income limits for childless EITC claimants continued to leave many workers without critical income supports. Federal economic security programs typically underserve non-elderly childless adults compared to other groups.11 The permanent EITC also largely excludes this population, yet these workers still need support to afford necessities. For example, the National Low Income Housing Coalition estimates that a person would need to earn $20.40 per hour at a full-time job ($42,432 per year) to afford the rent for a modest one-bedroom home.12 The pre-American Rescue Plan maximum income at which childless workers can claim the EITC is less than half that amount.

Young childless workers are entirely excluded. The tax code categorically excludes young adults (under age 25) without children from claiming the EITC but does not exclude young adults with children. Congress excluded young adults without children to avoid supplementing the incomes of students who were dependent on parents.13 Thus, young adults without children cannot claim the EITC, even if they do not receive family support.

Young Black people in this age group are highly likely to need income support. According to the U.S. Census Bureau, approximately 1 million young Black people (aged 18-24) lived below the poverty line annually on average from 2015 to 2019.14 Black students also face low incomes, with 59.8 percent of Black undergraduates and 65.4 percent of Black independent students living on low incomes in 2015-2019.15 According to the National Equity Atlas, 18 percent of Black 16-24-year-olds were neither working nor in school between 2015 and 2019, on average, compared to 11 percent of all 16-24-year-olds.16 Categorically excluding young adults without children eliminates critical income that could help these populations make ends meet.

Childless workers do not reap the labor supply boosting benefits of the EITC. For single parents, especially mothers, the EITC increases employment.17 Childless workers do not see these benefits. Since the EITC by design draws parents into the labor market, the program also indirectly lowers pre-tax wages for lower- and middle-income workers because of increased competition for jobs. Childless workers face those costs without the benefit of the substantial EITC payments that make eligible workers better off.18

Only custodial parents benefit from the EITC. The EITC does not provide support to noncustodial parents. In 2017, 48.8 percent of Black children had a noncustodial parent living outside their household.19 The IRS considers these noncustodial parents to be childless, and only the custodial parent can claim the EITC. Therefore, even if noncustodial parents provide substantial financial support for their children, they do not receive a significant benefit from the EITC.

The American Rescue Plan Temporarily Expanded the EITC

The American Rescue Plan temporarily and partially addressed several problems with the childless worker EITC. The law raised the maximum income limit and nearly tripled the maximum EITC for childless workers. The American Rescue Plan also lowered the eligible age from 25 to 19 for most childless workers, from 25 to 24 for students attending school at least part time, and from 25 to 18 for former foster children and current homeless youth. The law also eliminated the maximum age, allowing childless workers 65 and older to qualify for the credit.20 The age, income, and credit amount changes expire after tax year 2021.

According to the Center on Budget and Policy Priorities, the top occupations that will benefit from the EITC expansion in the American Rescue Plan include cashiers, cooks, and home health aides.21 All of these occupations employ disproportionately high percentages of Black workers.22

Table 1: Maximum EITC credits by number of dependents, adjusted gross incomes, and filing status (tax year 2019)

Table 2: Maximum EITC credits by number of dependents, adjusted gross incomes, and filing status (tax year 2021)

Recommendations

Policymakers should permanently expand the EITC for childless workers to increase after-tax incomes and reduce poverty. The American Rescue Plan temporarily expands the EITC for one year, and the Build Back Better Act currently under debate in Congress proposes a one-year extension of this expansion. Policymakers should make these changes permanent, as President Biden proposed in the American Families Plan.

Congress should further strengthen this expansion by permanently enacting the recommendations below. These changes would largely address challenges faced by childless workers who could benefit from the EITC. The proposals below do not address other issues with the EITC, including its complexity, high audit rates for Black communities, the need for more EITC outreach to hard-to-reach communities, or the exclusion of populations with no Social Security numbers. The recommendations below also do not address state EITCs, though several states model their state EITC benefits after federal guidelines and tie their credit amounts to the federal EITC.23

- Expand the age ranges for childless adults claiming the credit. Federal lawmakers should permanently lower the age of eligibility for the EITC to 18. This should include expanded EITC access for independent students to address poverty among young Black workers pursuing an education.24 Several policymakers have recently introduced or enacted legislation to address age limits for childless workers. The American Rescue Plan temporarily expanded the EITC to 646,000 Black workers aged 19-24 and 204,000 workers aged 65 and up.25 The American Rescue Plan also lowered the minimum age of eligibility for students to 24. The Foster Opportunity EITC Act of 2019 (H.R. 4954) introduced by Danny Davis (D-IL) proposed lowering the eligibility age to 18 for foster and homeless youth without children. The Working Families Tax Relief Act (S. 1138), sponsored by Sens. Sherrod Brown (D-OH), Michael Bennet (D-CO), Dick Durbin (D-IL), and Ron Wyden (D-OR) and its House companion H.R. 3157, sponsored by Dan Kildee (D-MI) and Dwight Evans (D-PA), would extend the minimum age to 19 and the maximum to 67 for the EITC. Several states have also expanded their EITCs to benefit younger workers. Rep. Bonnie Watson Coleman (D-NJ) introduced the EITC Modernization Act (H.R. 174), which would extend the EITC to eligible students.

- Increase the income eligibility for the childless EITC. The childless EITC can be claimed only at meager incomes. Policymakers should increase the maximum income levels for childless workers to be more in line with the needs of low-income workers.

- Increase the maximum benefit for childless adults. Policymakers must permanently increase the childless worker EITC benefit to reduce after-tax poverty and increase the impact of the credit for childless workers. This change could also increase labor force participation.

Policymakers must address the flaws in the design of the Earned Income Tax Credit. The changes proposed above are the minimum to ensure that policymakers provide support to help make work pay for low-income workers.

Acknowledgments

This issue brief is made possible by the Annie E. Casey Foundation and The Rockefeller Foundation. Special thanks to my colleagues at the Joint Center for their support throughout the project and for closely reviewing the report to ensure accuracy and clarity, including Alex Camardelle, Chandra Hayslett, Victoria Johnson, and Spencer Overton. Thank you to Barbara Ray for providing editing services. Special thanks to the Center on Budget and Policy Priorities’ staff for providing data and analysis support.

Endnotes

1 Hilary W. Hoynes and Ankur J. Patel, “Effective Policy for Reducing Poverty and Inequality? The Earned Income Tax Credit and the Distribution of Income” (Berkeley, CA: Goldman School of Public Policy, Nov. 2016).

2 Center on Budget and Policy Priorities, “Policy Basics: The Earned Income Tax Credit” (Washington, DC, Dec. 10, 2019), p. 2.

3 Chuck Marr and Yixuan Huang, “Women of Color Especially Benefit from Working Family Tax Credits” (Washington, DC: Center on Budget and Policy Priorities, Sept. 9, 2019), p. 1.

4 U.S. Census Bureau, Current Population Survey, 1968 to 2021 Annual Social and Economic Supplements (Washington, DC, historical tables).

5 Chuck Marr and Yixuan Huang, “Women of Color Especially Benefit from Working Family Tax Credits“.

6 Chuck Marr et al., “Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent” (Washington, DC: Center on Budget and Policy Priorities, May 24, 2021), p. 8.

7 Chuck Marr, “President-Elect’s Plan Includes Vital EITC Increase for Adults Not Raising Children” (Washington, DC: Center on Budget and Policy Priorities, Jan. 15, 2021).

8 Margot L. Crandall-Hollick, “The Earned Income Tax Credit (EITC): A Brief Legislative History” (Washington, DC: Congressional Research Service, March 20, 2018), p. 7.

9 Chuck Marr and Yixuan Huang, “Childless Adults Are Lone Group Taxed Into Poverty” (Washington, DC: Center on Budget and Policy Priorities, March 2, 2020), p. 1.

10 Ibid.

11 “Gaps in Economic Support for Non-Elderly Adults Without Children Continue to Leave Millions in Poverty, Data Show” (Washington, DC: Center on Budget and Policy Priorities, January 29, 2021), p. 9.

12 National Low Income Housing Coalition, “Out of Reach: The High Cost of Housing” (Washington, DC, 2021). The “housing wage” is an estimate of the hourly wage full-time workers must earn to afford a rental home at HUD’s “fair market rent” without spending more than 30 percent of their incomes on housing. Fair market rents are estimates of what a person moving today can expect to pay for a modestly priced rental home in a given area.

13 U.S. House of Representatives Committee on the Budget, “Opportunities to Improve the Earned Income Tax Credit” (Washington, DC, Nov. 30, 2018), p. 2.

14 U.S. Census Bureau, “1968-2021”; American Community Survey, 2019 5-year estimates, Table B17001B (Washington, DC: U.S. Census Bureau); Author’s calculations using data.census.gov as of Oct. 18, 2021.

15 Morgan Taylor and Jonathan M. Turk, “Race and Ethnicity in Higher Education” (Washington, DC: American Council on Education, 2019), pp. 2-3.

16 National Equity Atlas, “Disconnected Youth” (Washington, DC: PolicyLink and USC Equity Research Institute, 2021).

17 Nada Eissa and Hilary W. Hoynes, “Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply,” Tax Policy and the Economy 20 (2006): 73-110.

18 Jesse Rothstein, “The Unintended Consequences of Encouraging Work: Tax Incidence and the EITC,” Princeton University Working Paper (May 2008).

19 Timothy Grall, “Custodial Mothers and Fathers and Their Child Support: 2017” (Washington, DC: U.S. Census Bureau, May 2020), p. 3.

20 Margot L. Crandall-Hollick, “The ‘Childless’ EITC: Temporary Expansion for 2021 under the American Rescue Plan Act of 2021 (ARPA; P.L. 117-2)” (Washington, DC: Congressional Research Service, May 3, 2021), p. 3.

21 Chuck Marr et al., “American Rescue Plan Act Includes Critical Expansions of Child Tax Credit and EITC,” (Center on Budget and Policy Priorities, March 12, 2021), p. 8.)

22 Joint Center analysis of U.S. Bureau of Labor Statistics, “Employed Persons by Detailed Occupation, 2020″ (Washington, DC: Jan. 22, 2021).

23 Urban Institute, “State Earned Income Tax Credits” (Washington, DC, Aug. 15, 2017).

24 “Independent” students are not dependents of a tax filer and are in school at least part-time.

25 Unpublished Center on Budget and Policy Priorities’s analysis of the March 2019 Current Population Survey allocated by race or ethnicity based on CBPP analysis of American Community Survey data for 2016-2018. Estimates are based on the economy as of 2016-2018 using tax year 2021 tax rules and adjusting incomes for inflation to 2021 dollars.